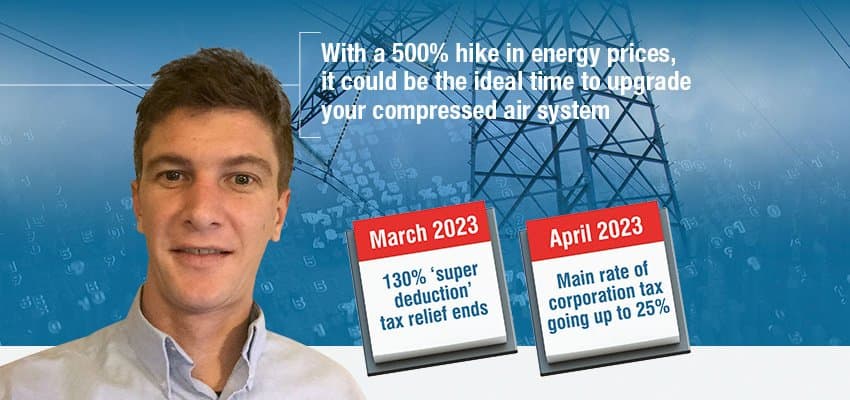

With 130% tax relief and a 500% hike in energy prices, is a new super energy efficient compressor the answer?

It could be the ideal time to upgrade your compressed air system

In a year of ongoing economic shocks and accompanying uncertainty brought about by The Bank of England announcement of a looming recession – it’s no surprise capital investment isn’t in the forefront of lots of business owners planning currently. However, with escalating energy prices, combined with the super-deduction capital allowance scheme, it may be worth reconsidering. Introduced in 2021 to cut tax bills by 25p for every £1 invested in productivity-enhancing new plant and machinery, the scheme specifically includes compressed air equipment.

Compressed air is one of the most expensive sources of energy in an industrial facility

In most industrial operations and manufacturing plants in the UK, the compressed air system is the largest user of electricity. In some sectors compressed air generation may account for 30% or more of the electricity consumed. Which means over the life of a compressor, energy costs will be five to 10 times the compressor’s purchase cost. Given the current energy crisis, the financial savings of running a new, super energy efficient compressor can rapidly recover the extra capital required – when compared to the costs of keeping with an older, less energy efficient model. Those companies who have already invested in modern, energy efficient compressors before the electricity price hike are enjoying the rewards of lower production costs compared to their competitors who are using less efficient technology.

Your old compressor could become your back-up system

You may argue that your old compressor runs fine, but a simple energy test can provide the calculation in different running costs. So you can accurately work out the payback on a new compressor on your current energy tariff. Many customers have used the 130% tax relief, combined with a new compressor to reduce their predicted energy cost plus bolster their compressed air system redundancy but using their old compressors as an emergency back-up. This is because it has become much more cost effective to purchase a new, significantly more energy efficient model than to overhaul outdated existing equipment.

The main rate of corporation tax going up to 25% from 2023

Deciding on the most tax-efficient mix of capital allowance claims and loss claims for 2021/22 and 2022/23 may be complex. You may need to balance current cash flow needs against the wish to get the most tax relief. But one thing is for sure; you’ll need to act fast.

Take a free Compressed Air System Safety Survey & Energy Audit

Cambs Compressors engineers can provide an expert objective assessment on your compressed air system, providing you with the facts on your running costs. The Compressed Air System Safety Survey & Energy Audit will also quickly identify any other inefficient equipment, maintenance procedures, and give you the relevant low cost/no cost measures to reduce your energy costs – such as leak detection and repair to reduce system waste.

To ensure we can provide the highest service levels and most responsive support, our Flexible Maintenance Support Agreements are only eligible to facilities operating within 50 miles of St Ives, Cambridgeshire but don’t worry, we’ll confirm this before wasting any of your time.